One of the bigger 2024 success stories on the Venture has seen 2025 become a struggle for Biorem bulls.

BRM tripled in value in 2024 going from 99 cents to $3.05 to end the year. Since then they have lost a little more than a third of that value, currently trading at $1.99.

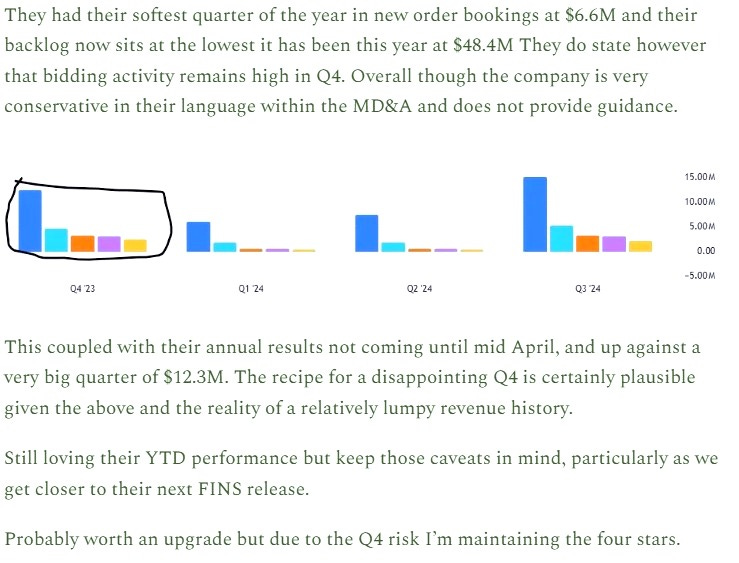

Back in November when I reviewed their Q3 I issued the following warning about their upcoming Q4.

It appears investors started to price this in with the stock starting the downward trend just as the calendar year turned. Not only did they not come close to matching off 2023’s $12.2M in revenue coming in 24% shy of that with $9.3M, but the company completely shit the bed on the margin line due to an accrual of labour costs for potential rework of a completed project. Biorem was still able to pull out a profitable quarter, showing some nimbleness within the remainder of their controllable expenses, but overall it still resulted in their year end results getting a downgrade from yours truly.

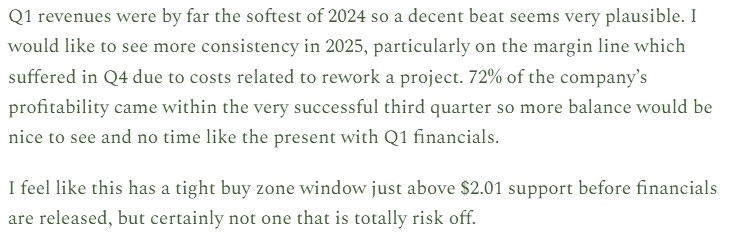

Coming into their recently reported first quarter, the concerns from the tough Q4 on a comparable basis looked like an opportunity coming into Q1. I had this to say from my May “What’s Wolf Watching” article from the middle of last month:

The market did not love the results when they were initially released with a large gap down on earnings day, but recovered late last week trading about where it was - in the $2 range.

I haven’t done a deep dive into the numbers yet due to a busy schedule of late, so let’s remedy that right now.

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year Seal of Approval picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

NEW - Access to The Wolf Den discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

With or without unearned revenue, Biorem has a solid balance sheet. With it removed, they sit with a 3.4 current ratio that is made up of $9.6M in cash, $6.7M in A/R, $2.8M in unbilled, $3.3M worth of inventory and $2M in prepaids overtop of just $7.2M of current liabilities going out the door over the next twelve months. A very good situation with liquidity ratios continuing to improve QoQ.

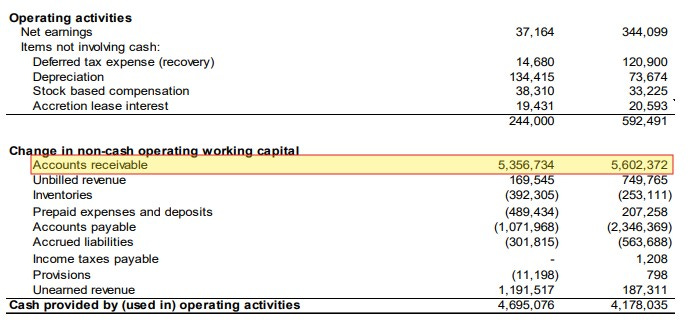

The company’s A/R is down by over $5M signaling what should be a great cash flow performance. Overall Biorem is very light on the notes they provide in their financial statements, only providing aging reports at year end. I also thought their aging report they did provide last month was a bit of a shit show. While they do not have a history of writing off large amounts of receivables I’m always for as much disclosure as possible and wish the company would do better.

Biorem has $2.3M ($1.7M long term) remaining on a term loan at 4% and an unused $3M LOC facility available.

Cash Flow:

BRM had a great quarter on the cash flow side with $4.7M generated via operations.

Before one gets too excited however this was all due to working capital changes, particularly within their collection of receivables. This is not a quarter where you can use as a trend to extrapolate what their potential annual cash flow will be. A nice result with a nice boost to the treasury, but it will not look this good in future quarters.

Minimal activity outside of operational side with $91k spend on assets and $200k on leases and loan payments. Overall they nearly doubled their cash position over the first three months of the year.

Share Capital:

No changes to the 19.4M shares outstanding at their year end. To see what I had to say about their share cap at year end, see my 2024 year end review. Normally I’d paste a link below, but it feels like a good time to point out wolfofoakville.com has a search function.

Income Statement:

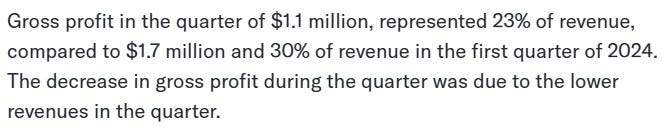

An awfully disappointing $4.7M of revenue in Q1 against $5.9M, a 20% year over year decrease and delivering their worst top line performance of their last eight quarters. Making matters worse was a 670 basis point hit to gross profit, with just 23.4% compared to just over 30% achieved in Q1 of last year. That equates to nearly 38% less margin dollars YoY - pretty piss poor when this quarter potentially looked like a lay up - instead it looked like Angel Reese trying to hit one from three point range.

If there is good news within this P&L, it is that the company was able to take 20% out of their expense line during the same time frame, therefore were still able to pull out a better than break even first quarter with Net earnings of $37k, but that is just better than 10% of what they achieved in the comparable start to the year in 2024.

Overall:

When you deliver back to back shitty quarters, you put out a headline resembling this.

In fairness, if I was on their communications team, I would have written similar to try and distract investors - it rarely works but you do have to give it the old college try.

Within the MD&A the company explains that Q1 was off to last year due to a large project in the middle east being pushed into Q2 and Q3.

Their explanation on the margin line reeks of hot garbage however as the decrease is certainly more problematic than just lower revenues when you have nearly 700 basis points in erosion.

Perhaps I would have let this one slide if it were not for their margin performance in Q4. I’m sensing a trend, and it’s one I don’t care for.

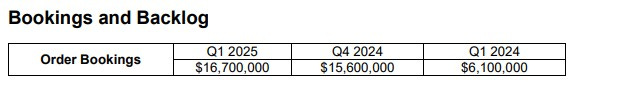

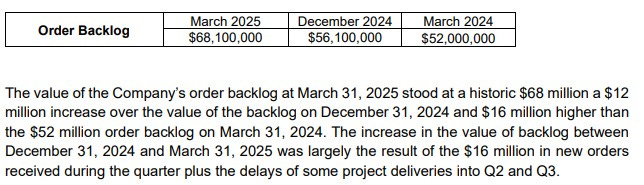

On the more positive side was their Q1 bookings and where their backlog sat at the end of the quarter, a company record. Eventually you need to start putting the biscuit in the basket though and for the last six months Biorem have looked like Matthews and Marner in the post season (the sports analogies are on fire this morning).

I’m encouraged by what seemingly appears to be the company’s flexibility within their operational spending. Even with a suffering top line and margin numbers over the past two quarters, they did actually deliver their seventh straight profitable quarter. This points to a combination of a highly variable expense structure and good operational management - two things you really like to witness when investing in a business that can have lumpy revenue quarters.

Biorem is also trading at very reasonable multiples at about 1 P/S, under 6 EV/EBITDA, with a P/E of 13.6. They also tout a very impressive 23% ROIC.

I do get a little nervous when I look ahead at their third quarter when they delivered record revenues, gross profit and net income with the latter representing 80% of their TTM profitability.

There is still reason for bulls to be excited regarding their longer term prospects, but they are in a desperate need of a bounce back when they report Q2 to maintain my interest and my investment. I will not hang around for Q3 results if Q2 turns into a threepeat of disappointment.

A second consecutive downgrade to 3.25 stars.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.