Ok, this is the last cannabis stock I’m going to review for a while. So if you’re thinking of requesting I review another one. Don’t.

In all seriousness, my increased coverage of the sector has been for good reason. The sector has also become a larger part of my microcap portfolio in the last year as well. As a contrast to a few years ago, there is actually some cannabis stocks worth talking about. I’m not talking about some of the larger players like Tilray, Canopy, Terrascend or Aurora who together have wiped out tens of billions in shareholder value combined. I’m talking about Canadian microcap players who actually have some good and improving fundamentals. These are ones that trade on traditional investing metrics (or at least starting to), and not just hopium whenever there is a rumor out of the US Congress or White House.

I’m talking about sub $200 market cap names like MTL Cannabis (MTLC), Cannara Biotech (LOVE), Rubicon Organics (ROMJ), Decibel (DB) and others who would like to be in that conversation such as Simply Solventless (HASH) and Glow Lifetech (GLOW).

If I missed your favourite, stay out of my mentions - don’t be that “reply guy”. I really don’t care.

Auxly is larger than any of the above at a $205M market cap and trades on the Canadian big boy exchange unlike the other six I mentioned. Over the Christmas break the stock traded as low as two and a half cents. On the day of their earnings it hit 18.5 and has now settled in at 15.5, which is 9% down from the day prior to the earnings we’re about to review here.

This is my first formal look at Auxly, and the one thing that stands out is their consistency across the last five quarters. Revenue growth in all five were well into the double digits with four of them over 25%, and all profitable on the Net Income line.

It also trades at 7.7 earnings and 10 times cash flow. It sounds like I’m going to have to like it, right? Let’s find out and get this done in time for my afternoon weed delivery.

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year “Seal of Approval” picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

Access to The Wolf Den Discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

A disappointing start with a current ratio of just .76 that consists of $17M in cash, $21.2M of receivables, $40.4M worth of inventory and biological assets and $3.4M of various other short term assets over a daunting looking $108M of short term liabilities.

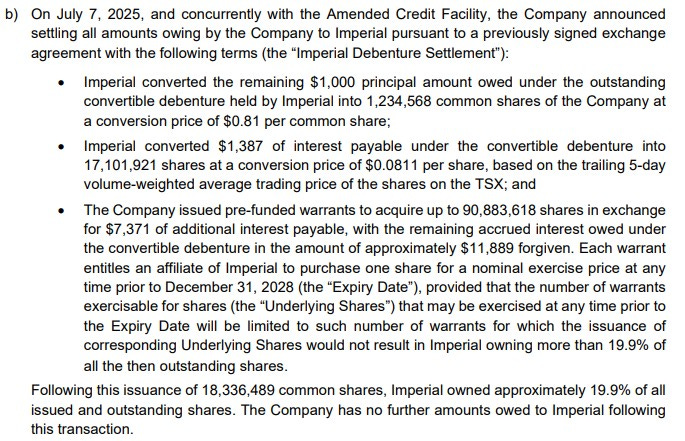

Of their 28 pages of financial statements and notes, the portion covering Convertible Debentures, Loans and Promissory Notes span from pages 12 to 19, and 28. It’s a bit of a complicated mess with the most important page being the last under subsequent events which might render looking the balance sheet as of June 30th as relatively useless. Let’s try to make sense of it all.

At the end of June, over 60% of the company’s one year financial commitments were related to debt with another $2.9M in long term debentures and promissory notes. By mid July, they were able to re-finance or settle the vast majority of it.

The largest portion, a $33.9M credit facility was revised and extended from the end of this year to June 30, 2027 and also includes access to a new $10M revolving facility.

The next largest was $20.6M in interest payable to tobacco giant, Imperial Brands. This relationship goes back to 2019 when Imperial invested $123M into Auxly in the way of 4% convertible debentures. These debentures were originally set to expire in 2022 at 81 cents, but were subsequently amended a number of times. In March of 2024 when the stock was trading between one and two cents, Imperial made an interesting move by converting $122M in principal at the original 81 cents into 150.4M shares, and $1.6M in accrued interest was converted into 90.9M shares at a more appropriate market rate of 1.7 cents. That left $20.6M in interest owing that would no longer accrue any additional costs. Are you still with me, because it’s about to get more complex.

As you can see above, in addition to the $20.6M in interest payable, $1M was still left on the principal amount. That was converted into 1.23M shares and a small portion of the interest, $1.4M was converted into 17.1M shares at just over 8.1 cents. Using that same 8.1 cent figure they converted an additional $7.4M of interest into 90.9M pre-funded warrants which will expire at the end of 2028. That leaves $11.9M of interest which was essentially forgiven. Therefore as of July 7th, the company is finally free of their debt burden in relation to Imperial Brands.

At the end of the day what did Imperial Brands get for their 2019 investment of $123M? A 19.9% stake in a $205M market cap company with a current value of $40.8M. Not a very good return on their investment so far. So why would they forgive nearly $12M of interest? It could be viewed as a bullish indicator from Imperial’s view to choose equity over cash, but then again maybe not. Imperial clearly wants to keep their ownership level below 20%, as that would involve additional regulatory requirements and it seems clear they do not want to have them report as a subsidiary within their own financials. One of the important previous revisions to the debentures also removed an exclusivity clause which allows Imperial to invest elsewhere in the sector allowing them to hedge their bets. Regardless of how you look at it, Imperial let’s Auxly off the hook here which really frees up their balance sheet and gives Imperial the best chance of recouping their investment if Auxly can perform. The nearly 91M warrants ensures they can keep 19.9% ownership over the next three years if future dilutionary takes place on an already massively bloated float. We’ll get to that later.

In addition to the two large debt items, they also extinguished what was remaining on an A/R financing loan with Savent financial, and promissory notes with Fresh Energy. I believe in terms of current liabilities what remains is a loan with GrassHopper Capital at 18% and portions of a promissory note due to Peter Quiring.

When the company releases their Q3 in mid November they should be reporting a much more liquid and attractive looking balance sheet overall.

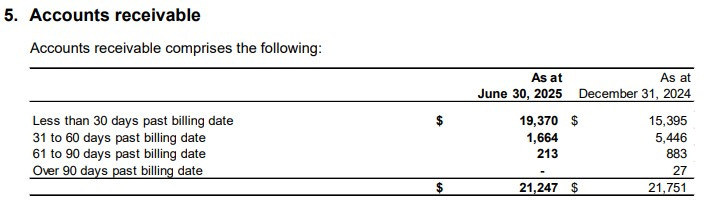

In terms of other balance sheet items, their A/R looks quite strong in terms of their aging report with 91% listed as current, also much improved from the start of the year.

Inventory including biologics is up 19% from the start of the year and accounts for about 50% of the company’s current assets. Auxly’s cash + receivables looks like it now just about covers their remaining liability commitments over the next year, so it will be important to re-evaluate the shape of the overall balance sheet in a few months time.

Cash Flow:

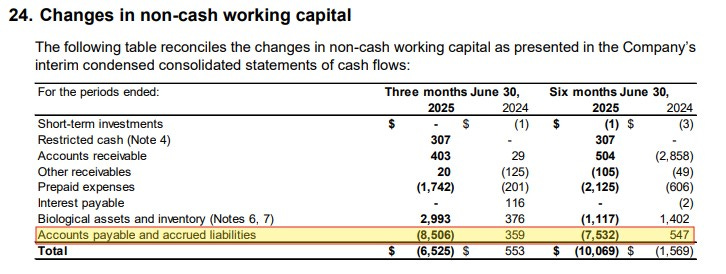

Through six months, Auxly has produced $5.6M of operational cash flow (OCF), over 8 times the $891k delivered at the same time last year. That includes $3.6M generated in their last quarter. What is also interesting is that includes a rather large negative impact of working capital adjustments to their OCF - mainly from significantly paying down their A/P.

Given that, you could probably expect their OCF to even improve further in future quarters.

Other significant items within their cash flow statement include $5.9M of debt reduction, $447k received via warrants and small asset purchases of $290k.

Overall, their cash position has depleted from the start of the year by a rather negligible 7%.

Share Capital:

This is not a pretty section.

As of June 30, 1.32B shares outstanding which includes 30% dilution in fiscal 2024 alone.

Including the 91M virtually free warrants held by Imperial, a total 171M warrants outstanding. The remaining 80M are well ITM at 4.5 cents

15.7M options outstanding. The company does not provide a great table but I believe only 2M are currently ITM at 2.5 cents

158.1M outstanding RSU’s. Over 159M awarded in the past 18 months with 51.5M vesting in 2024. We will be visiting present and Management Info Circulars later on

19.9% ownership by Imperial, about 4.5% via insiders

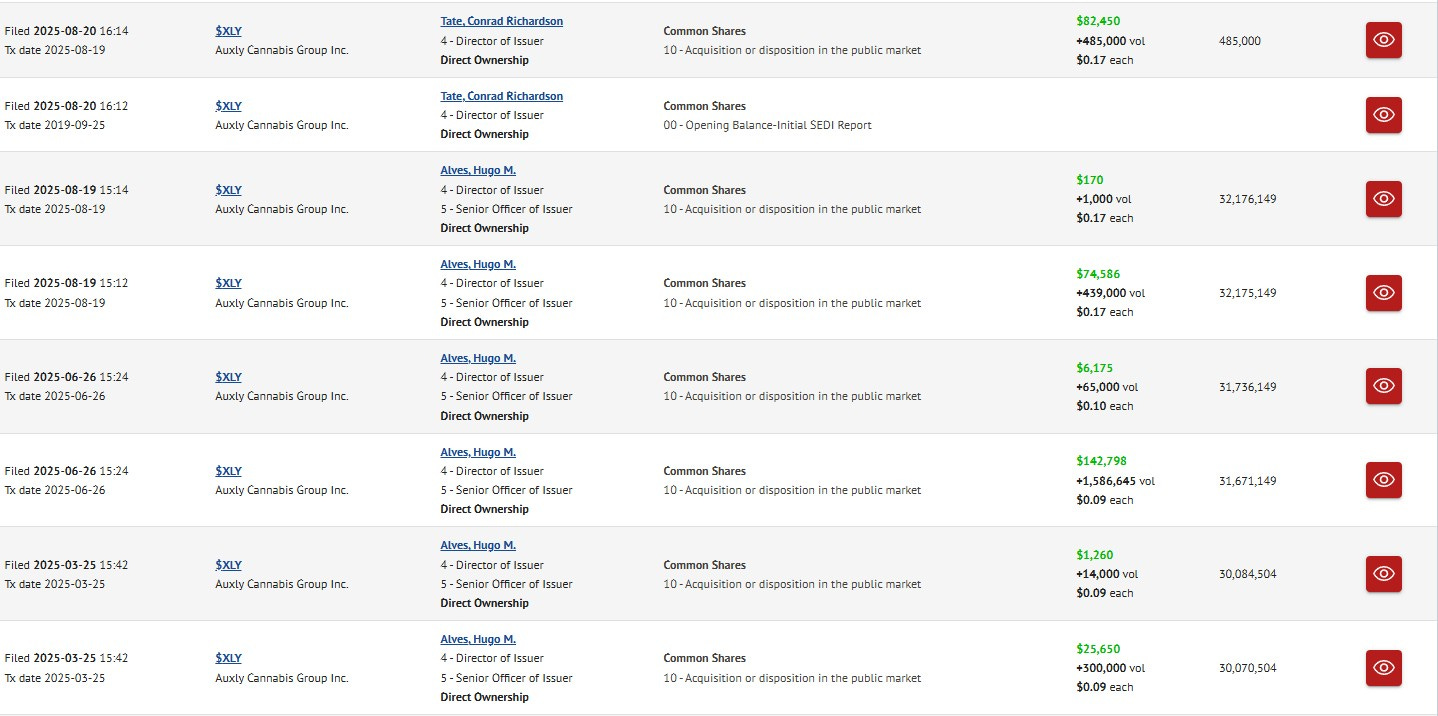

YTD insiders have purchased 2.9M shares including the CEO who has ponied up $333k so far this year for 2.4M shares

To be continued:

Income Statement:

This is where the company has made the most progress. Q2 saw revenues grow by 33% to $38.8M. Their gross profit rate grew by an impressive 380 basis points to 58.5% and that helped gross profit dollars grow by 42%. Continuing with the impressive metrics is very little growth within their operating expenses, only 5.2% on all of that top line and margin growth. Much of that improvement went straight to the bottom line with $8.3M worth of net income, over 4x what they achieved last year.

From a YTD perspective it actually gets better:

31% revenue increase through six months to $71.5M including 19% QoQ growth

Gross profit dollars increased by 73% thanks to a 1200 bp improvement in their GP rate

Operating expenses decreased year over year by over 10% in large part due to reduced interest and accretion expenses

Net income of $20.4M vs a net loss of $24M but $8.1M of that is through an unusual item via tax deferrals.

Both the quarter and YTD performances in revenue, margin and expense conversion award them the coveted Wolf Trifecta.

Overall:

That $8.1M which makes up 40% of the company’s profitability should be backed out of their net income for a more appropriate P/E calculation based on a better NNI figure. By doing so takes it from a reported 7.7 P/E to a more realistic 17 P/E. Based on that, I feel this 15-16 cent area is probably pretty appropriate currently.

On the other hand, all of that $8.3M of net income in their second quarter is all legit. In most cases I would say it’s a stretch to try and annualize one quarter of profitability, but given the revenue, margin and expense performance coupled with the potential for further expense savings on interest costs due to debt reduction and restructuring, I don’t think it is that big of a stretch. Therefore $8.3M in Q2 translates to $33.2M of net income annually and that give you a very eye opening 6.2 P/E. At a rather simple 12x extrapolated earnings that’s a market cap of $398M or a share price of 30 cents, suggesting a potential 94% upside from here.

BUT…

Here is why I think you should throw a lot of what I had just said out the window and put a heavy discount on that. Or at least here is the rationale for why I am and it comes down to an SBC plan that has violated shareholders more than Ned Beatty after his canoe trip in Deliverance.

At the beginning of 2024, Auxly’s share count sat just above 1B shares (1,013,000,000). Since that time management has awarded over 159M in RSU’s. That’s nearly 16% dilution occurring directly as a result of share based compensation in a span of just six quarters.

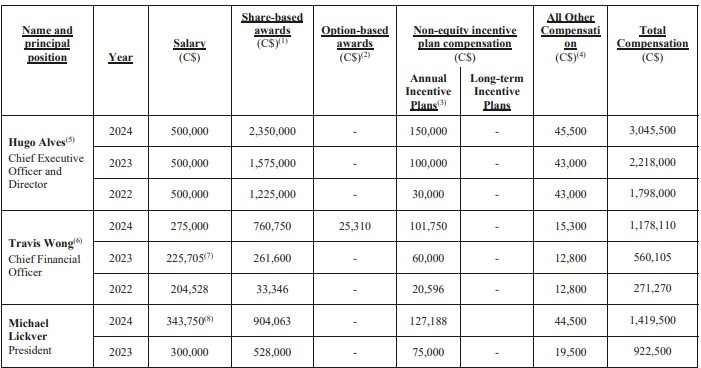

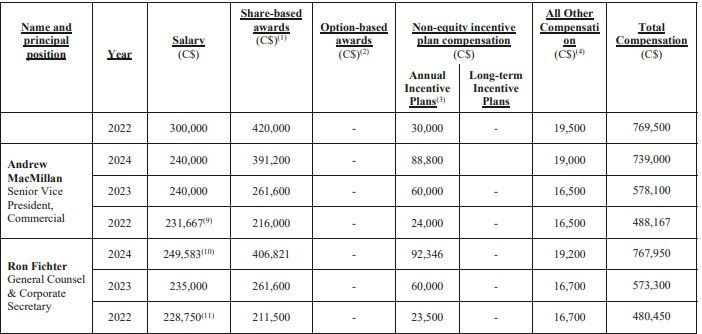

Above is the table of executive compensation for senior management for the past three years. I’ll let everyone make their own judgements whether or not this is fair compensation for a company that prior to this year had amassed a half billion in net losses since their inception.

One trend over the past couple of years, particularly for underperforming companies is a move from option based SBC plans to a RSU/DSU/PSU or similar model. From 2018 onward, options were predominantly given as SBC within Auxly. Due to the long term chart looking like it does (pictured below) the vast majority of those options awarded over the years have or will expire unexercised and worthless. So enter the RSU plan over the past eighteen months to make up for lost time I guess.

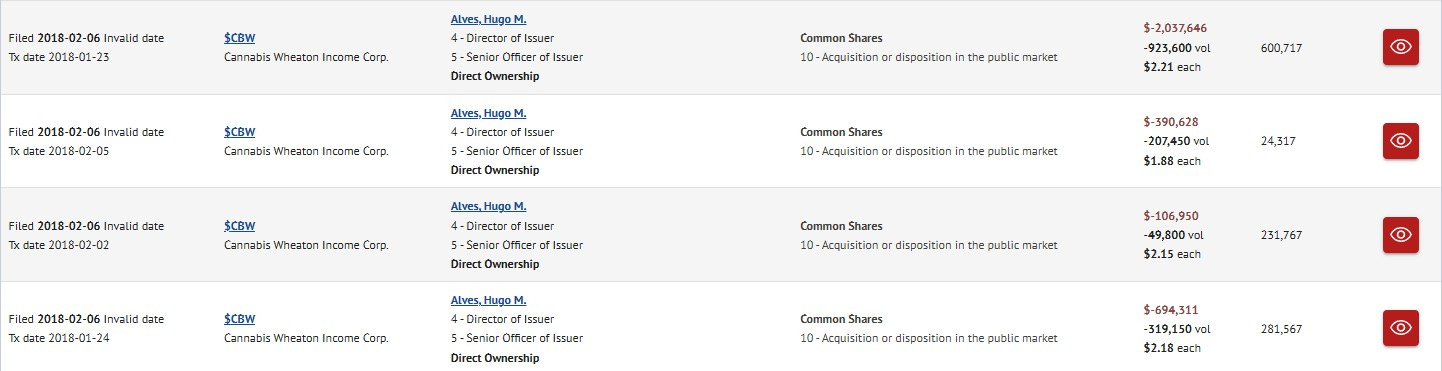

I see a lot of posts on social media glowing about the insider buys, particularly from the CEO. To remind you it was total buys in the open market of 2.4M shares totaling around $333k. Prior to this according to SEDI, you can find about $480k spent on either the open market or exercising two cent warrants since 2017. Of the 52M common shares and another 35M in unvested RSU’s he owns, he really hasn’t gone in his pocket very much.

Also, four months prior to the name change to Auxly Cannabis, the CEO peeled off over $3.2M worth of shares when it traded as Cannabis Wheaton Income Corp. So I’m pretty sure he’s still sitting well ahead in the grand scheme of things.

So the fully diluted float of 1.65B shares without knowing what future SBC costs will look like does change things for me to the point where I can’t see myself ever being a long here. There is also an inevitable reverse split to take place as well.

This will be very tempting to swing trade XLY going into earnings if this stays in this area close to November. But I’m not getting married to this float, nor this recently greedy leadership group.

(Note: this took much longer than expected and I did not complete it before my delivery came. Gummy anyone?)

Three stars.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.