It feels borderline criminal that I haven’t done a review on a 2023 annual pick in about a year now.

Stock price has seen it’s ups and downs but overall it has shown a nice upwards trend since my first four star review well over two years ago.

That’s about when I first put some money in the stock, in the 50-60 cent range so it’s been a nice double and then some. I also selected it as a 2023 pick of the year and it is up 70% from then. A nice return, although that would just rank it 7th of my 10 annual picks in the last two years behind NCI, HBFG, KITS, SBBC, PNG and E. That just makes me think there is more opportunity ahead for Atlas. But let’s review their latest financials that came out a few weeks ago while I was on vacation.

Balance Sheet:

One of the healthier current ratios you will see on the Venture at 4.2. That consists of nearly $20M in cash, $7.75M in A/R, $8.5M worth of inventory and about $1M in other short term assets over top of just $9.5M in short term liabilities.

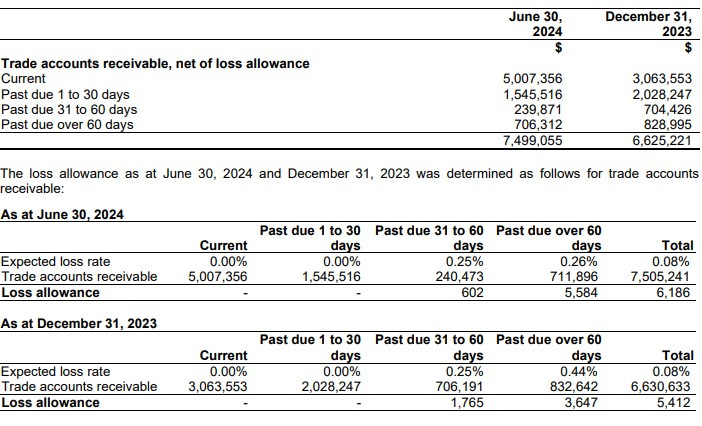

A/R is up a little bit but I’ve always appreciated Atlas’ disclosure and I don’t see much concern. They’ve always seemed to be a company that will let receivables slide for 30 days and then bring the hammer down.

They do have $25.8M in debt, $3.1M being current. All of their existing debt as of June 30th is with TD at mediocre rates in the 8.25 - 8.50% range. They have paid off two other loans with the BDC so far this year. $4.2M are mortgages that don’t mature for two decades.

Cash Flow:

Operational cash flow generated YTD of $1.8M, 284% better than where they were at this stage last year. All of that success came in the second quarter with nearly $2M of cash generated through operations. Working capital changes are hurting their YTD number due to growth in receivables and greater inventory investment, so it’s possible this will trend better for the back half of the year as some of these timing variances balance out.

The company utilized $2.1M in investing activities including the wrap up on the LCF acquisition, paid down $7.8M worth of debt, and received $14.6M in a bit of a surprise raise in the back half of this quarter.

Overall their cash balance improved by 176% from the beginning of the year, mainly on the heels of this raise. The PP is reported to be for some pretty substantial upgrades to 3 facilities for robotics automation. Watch this space to see how that is invested in future financials.

Share Capital:

Big change since last reviewed with 70.2 million shares outstanding, 22% dilution in the past year via the PP and acquisition of LCF

2.5M options all well in the money

17% insider ownership per YF

Insiders have bought on the open market at prices above where we currently sit and five different insiders participated in the recent PP - although I wouldn’t suggest they were mind blowing amounts

The largest insider transaction on the open market was actually the CEO & founder selling 250k shares at the same time he exercised the same number of options, pocketing a cool $195k in the process

Income Statement:

Well, after a series of quarterly stinkers, Atlas shareholders had a little more to celebrate this time around.

Revenues came in at $15.1M, 34.5% better than Q2 of last year. That helped dig them out of the hole they created in Q1 on the top line, as YTD they have now achieved $24.2M, 16% better than the $20.8M they did at the mid way point last year.

Gross profit is a much different and mixed story however. The quarter looks fine with margin about 50 basis points higher than last year at 30.7%. There is no way to polish the turd they dropped on the market in Q1 however with under 16% GP, so YTD they are still lagging by over 500 basis points at 24.2%. Their six month gross profit dollars are actually $400k less on $3.4M more business.

Operating income is mixed as well for similar reasons. Q2 was 28% better than last year, but on a YTD basis is 69% worse with $610k vs $1.95M. YTD looks atrocious and you could also make the argument that Q2 didn’t show great conversion with 28% more operating income on 34% more revenue. I’ll make the argument that this is much better than it looks on the surface as actual cash burning expenses only rose by 7.7% in the quarter, and 10.2% YTD, with the major differences in operating expenses coming from depreciation and amortization which was more than triple in the quarter and more than double YTD.

I’m much more concerned about the interest expense between the operating and net income lines at $1.07M vs $408k which reverses a YTD net income of $1.9M into a $386k net loss.

LCF Acquisition:

Just over a year ago, Atlas completed it’s acquisition of Léon Chouinard et Fils Co (but we’ll just refer to it as LCF to avoid remembering how to use the accent aigu).

They paid $26M, and the initial press release cited 2022 figures of nearly $26M in revenues, EBITDA of $9.5M and net income of $6.3M. Those work out to incredible 2.5 year EBITDA and 4.1 year net income payback periods, metrics I will take any time for an acquisition. It also gives Atlas greater coverage coast to coast.

Overall:

Remember those glowing things I just said about the LCF acquisition up there? Things are about to take a wee turn.

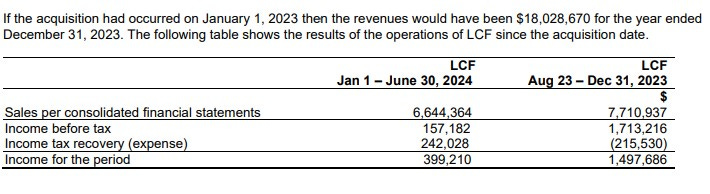

The 2022 figures were outstanding, but had the acquisition occurred on Jan 1 instead of the end of August in 2023, revenues were estimated to be $18M, a 30% decline over 2022.

The profitability so far this year on LCF is also far from the 25% driver of operating income that it did in 2022 as well, so at that rate those quick payback periods on the acquisition date get extremely longer.

When you remove that $6.6M worth of business that LCF has done through six months, it means their organic businesses delivered $17.6M compared to $20.8M, about a 15% decline. That $6.6M also trends out to about half of what they did in 2022, and the story goes from what a steal Atlas made to did the Chouinard family make out like bandits here?

It’s probably somewhere in between, but when you look at the breakdown of LCF numbers and the continuing organic decline in AEP’s historical businesses it confirms that the macro environment they operate in is still far from ideal.

Is their much more positive Q2 results a sign that the tide is turning? That’s probably too early to say, but there are some positive indicators in their favour. In July, housing starts hit a 13 month high, interest rates are retreating and we’re getting closer to a Canadian election season where all political parties are promising action on the countries housing challenges.

We even had the betting favourite for the country’s next Prime Minister tweet about Atlas just last week, even though he got the companies name wrong with the acronym right behind his smiling noggin in the above photo op.

(By reading this piece you hereby agree to never let Mrs. Wolf know I used a photo of Poilievre)

The latest quarter also suggests the company may have bottomed from a revenue standpoint after five consecutive quarters of declines. They also took a very bold step issuing a PP in a tough environment to make investments in their manufacturing processes. This is not a move made by a tentative leadership after having their asses handed to them for the last year and a half, and I have to tell you I’m here for it. The timing could prove out to be one of the best investments the company has ever made.

I don’t think the rewards are going to be immediate so investors will have to continue to show some patience. Given the last year and a half of results, and macro environment the valuation and share price have held up quite positively. I think that comes from a strong investor base continuing to believe in company leadership. It’s a big reason why I’m still around without selling a single share.

These are not the four or four and a half star financials of a couple of years ago, and that’s just a fact, nor is it the bargain of 2.5 EV/EBITDA when I named it a 2023 pick of the year.

Struggling with a rating but I’m going with 3 stars and adding a 1/4 for their most recent performance and my belief that much better days and much better reviews are ahead. Contender for 2025 POY?

Have an request to review a stock you are interested in? Visit the TSA discord to make your request in our dedicated channel or email us at thewolf@wolfofoakville.com

Chat with me and 2900+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings and I do so without compensation. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

No significant difference of opinion from me. Well written as always. atlas is one of my largest holdings. my current feeling is that investors might have been overly optimistic a couple years ago about growth prospects these last couple years but at the same time they have an amazing opportunity with geographic expansion and robotics improving the quality of their operations and allowing them to find the next gear. this will take at least a few more years to see how well it works out. there are still a lot of long term secular tailwinds going for them so I’m quite happy to watch it play out.