I can’t say I’ve been looking forward to this one. We knew it was coming, and the expectations were not high. Is it just me or is the initial glance not that bad?

My previous review for this 2025 Wolf Pick was rated R, as I didn’t feel awarding a typical rating based on the US tariff situation was meaningful. For what I said in April, see below.

Here is a summary of what ADF Group delivered in 2024 and the metrics it traded at prior to this morning:

Revenue of $340M - up a modest 2.6% with 33% growth in Q1 followed by three negative revenue quarters

$57M of Net Income, up 51% from 2023, producing over 16.7 cents of profitability for every revenue dollar.

.58 P/S ratio

1.9 EV/EBITDA

3.6 P/E

34% ROIC

Despite those excellent fundamentals, the stock is down nearly 60% over the past twelve months, and roughly 30% since my mid December pick.

How can this possible be? To sum it up, this douchecanoe:

In that recent April review, I called 2025 a potential write-off year for DRX unless there was swift action on tariffs, particularly on steel. That certainly has not happened. Making matters more challenging coming into their first quarter earnings was that last year was a record setter with $107M of revenue and over $15M of profitability. While the CEO did not provide specific guidance, indications were that the first half of 2025 would be soft.

With Q1 numbers now in as of this morning, let’s have a gander and see where we sit.

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year Seal of Approval picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

NEW - Access to The Wolf Den discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

Current ratio remains strong at over 2.4 that consists of $75.2M in cash, $56.2M in receivables, $32.9M in contract assets, $14M worth of inventory and $5.2M in other short term assets over $75M of liabilities due within the next year. With their cash position covering their total current liabilities, liquidity looks quite solid.

Receivables down by $27.7M from their year end has a good and bad story. It will positively impact cash flows for the quarter but on the flip side did not have the same amount of revenue to turn into future cash flows.

ADF Group has $37.2M of long term debt and $17.7M in deferred taxes commitments.

Cash Flow:

The company had $25.3M in operational cash flow (OCF) in Q1 compared to a cash burn of $22.2M in Q1 of last year. Both numbers heavily influenced by working capital adjustments. Last year A/R rose dramatically due to higher revenue creating higher receivables and a negative impact on OCF, and this year the opposite. The correct or expected number to rely upon is somewhere in the middle, but overall a sold start to a year with many challenges.

ADF Group utilized $1.5M in the quarter but more importantly repurchased $5.1M of stock in the quarter. I have mixed feelings about this. You always want to signal to the market that you are undervalued but I do empathize with the number of staff who’s hours have been reduced due to the tariff fears. I don’t think it sends a great message to them. I have a theory that if you prioritize your customers and employees, that is the often the best recipe to provide long term value to shareholders. I’m not sure those actions coincide with that thinking.

Overall the company improved their cash position by $15.3M or 25% during Q1.

Share Capital:

28.5M total shares including 12.1M multiple voting shares. That is 2.3% fewer shares than the start of the year due to the share buy backs of near 700k shares.

All other data is similar to year end so you can refer to my previous review for those details (link in the introduction).

Income Statement:

Revenues due to the tariff uncertainties declined by 48% from $107.4M to $55.5M in Q1 and those also came with lower margins of 22%, down by 700 basis points due to the higher costs of steel south of the border.

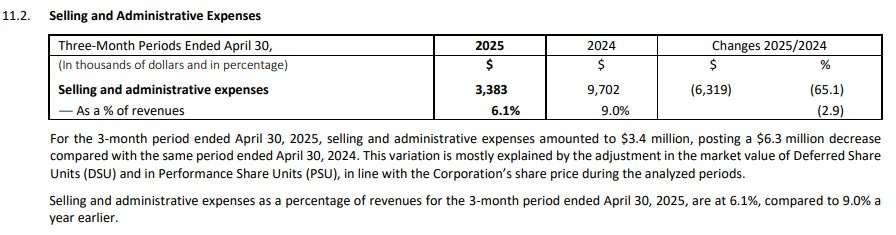

SG&A expenses came in at a staggering 65% lower than Q1 of last year. This was mainly due to vesting costs of RSU and DSU’s. I do wish the corporation would provide a better breakdown of this bucket to see how much they were able to be nimble with payroll costs and potential future impacts of the work sharing program implemented in their Terrebonne plant.

With only half the tax burden given their lower revenues and the beneficiary of a $2.9M foreign exchange gain, they pulled out a rather impressive profitable quarter of $8.7M, maintaining that 16% profitability ratio from 2024.

Overall:

The conference call was quite positive, as is the market reaction despite the near halving of their YoY revenue.

The stock is currently up 18% one hour into the trading day, challenging an $8 resistance point and bordering on overbought currently.

While investors were aware of what would be first half struggles, the CEO sounded rather optimistic regarding the back half of the year suggesting $80-$85M in Q3 and Q4 would be in the cards which would represent increases over 2024. Of course the caveat being things remain consistent with the tariff situation and anyone who thinks they can predict that is seriously fooling themselves. Backlog numbers have also risen to over $330M which is also very encouraging.

Looking at valuations if we just extrapolated Q1, that would deliver about $220M in revenues with about $33M in profitability. At a current approximate intraday market cap of $225M, that would put the company still trading at under a 7 P/E and under 1 on a P/S basis. With Q1 maybe being as worse as this is going to get with potentially much larger guidance in the cards for the last two quarters of the year, maybe my previous comments about a lost year were premature.

Very difficult position in nailing down a rating here. I’m going with 3.5 stars. Without the last year tough comparison it would be higher, but the strong balance sheet, FCF and ability to still drive profitability still garners that high of a rating here. I think the management team in the way they have handled all of this uncertainly and uncontrollable external challenges really solidifies my thinking when I chose them as a 2025 Wolf pick, regardless of how the share price performance has been.

They’ll be back.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

I don't own any stock, but this company seems very well-managed.