If you’ve been following this 2025 Wolf Pick and their story throughout the year, you know the company has been through some things. If you haven’t, that becomes evident by just looking at the one year chart, down 15% since the Dec 2024 pick. If you wanted to sum up the reason for their volatility, you can probably do so with one word - tariffs.

While I had low expectations for these quarterly results, my first glance suggests they even missed that very low bar. The stock dropped as much as 18% on earnings day. Later in the review I’ll tell you why i tried unsuccessfully to buy the dip from the golf course. For now, let’s get into their Q2 financials.

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year “Seal of Approval” picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

Access to The Wolf Den Discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

ADF Group sports a strong current ratio of over 2.2 that consists of $50.9M in cash, $84.2M in receivables, $18.3M worth of inventory and $28M in other short term assets over top of $85.3M in liabilities due over the next year. Cash and receivables easily cover their one year commitments suggesting strong liquidity as well.

Given their revenue performance in the quarter I am surprised to see their receivables grow so substantially QoQ, and this will likely have an impact on cash flows. Unfortunately the company does not provide an A/R aging report.

ADF has $36.2M of long term debt (down $2M from their year end) and $16.9M of deferred tax liabilities.

Cash Flow:

A very rough looking statement with just $7.4M in operational cash flow generated through their first two quarters compared to $60M at their half way point last year. There really isn’t anyway to put any lipstick on this pig, but I will say timing differences within their A/R is likely a factor here and I would anticipate this improving as the year goes on. Due to their large contract work, they are susceptible to large swings within their OCF.

So far YTD they also utilized $2.8M in asset purchases, bought back $7.9M worth of shares, paid down $2.1M of debt and paid out $575k worth of dividends.

Overall, they have depleted 15% of the cash position from where it stood at the beginning of the year.

Share Capital:

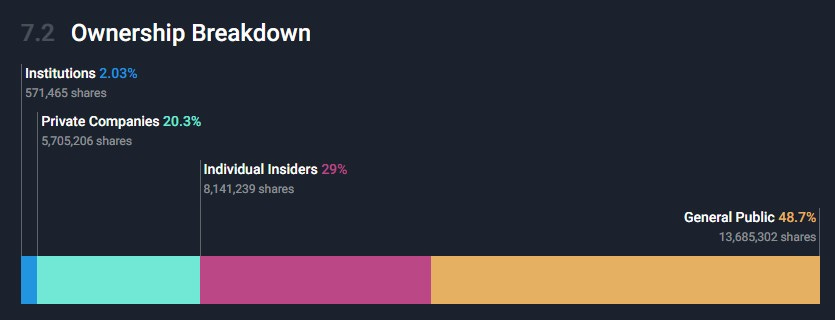

28.1M shares outstanding made up of 16M subordinate and 12.1M multiple voting shares

1.05M subordinate shares repurchased YTD

51% ownership between insiders, institutions and private companies

Income Statement:

Revenues for Q2 came in at $53M, off 29% to last years $74.9M. Margins also came in quite poor at 20.7%, down from 36.9% and to top if off, SG&A expenses were more than double, mainly due to increasing market value of their share based compensation, although YTD, their SG&A expenses are down 12.5%.

That all adds up to the complete opposite of a Wolf Trifecta, and as a result their net income for the quarter was $900k vs $16M last year.

Overall:

While most investors expected a soft quarter, the margin was certainly lower and selling and admin costs higher than everyone was anticipating. So why was I looking to add shares last Thursday?

Despite the tough quarterly results and the challenging environment they are operating in, the future is still very encouraging, particularly at today’s valuation. If the tariff issue eventually gets resolved that will only present additional catalyst opportunities. While the Q2 was worse than expected, the second half is expected to be much better, as well as multiple reasons for optimism for 2026 and beyond.

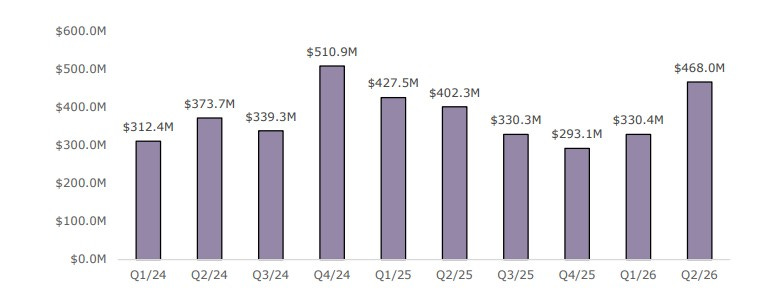

First is their backlog which is up 42% QoQ and 16% over where they stood at this time last year, and as you can see by the table below, the second highest figure it has been in the last 10 quarters. This also does not include a five year extended option on their contract announced to support an infrastructure project in Quebec.

Nor does that backlog amount include the proposed acquisition of LAR which would add $105M in revenues that much of which would be realized short term. The finalization of that deal could be announced imminently. The deal not only takes out a competitor, but also adds synergies and reduces reliance and minimizes current risks from their USA business.

Additionally, DRX is likely poised better than most at benefitting from the Liberal governments fast tracking of infrastructure projects.

When you combine all of that with the current metrics ADF Group is trading at - under 7 P/E, under 4 EV/EBITDA with a 18% ROIC and IMO a great leadership group who has navigated a very tough macro situation all are reasons I’m looking for opportunities to add and not subtract here.

No getting around the terrible quarter however and for that reason I must downgrade to 3.25 stars.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Thanks for the review, Wolf. Like you said, bad quarter but this company has a lot going for it, esp. that Quebec deal.

What software do you use to download the financial data shown in the screenshots?