ADF Group released their financials last week while I was sipping margaritas on a Mexican beach. You would be hard pressed to point out a company that has been affected more due to the Canada/USA tariff situation than them, dropping down to a low of around $5 after Trump’s “Liberation Day” and suffering a near 50% decrease in revenue in their first quarter. It’s safe to say it wasn’t the start to the year I was hoping for after selecting them as a 2025 Wolf Pick late last year.

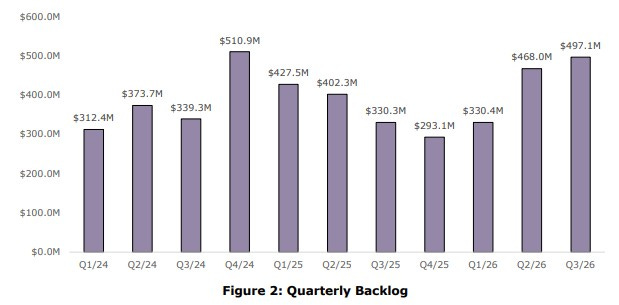

Their Q2 wasn’t much better, with a 30% revenue decline while delivering their weakest profitability quarter in several years. There were some encouraging signs in that quarter however, with improved backlog and their proposed acquisition of LAR which later closed in mid September potentially positioning them for not only a better back half, but a much stronger 2026.

Let’s dig into how Q3 turned out. I haven’t delved into them yet, so we’ll be walking through them together.

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year “Seal of Approval” picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

Access to The Wolf Den Discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

ADF sports a strong current ratio of 2.3 that consists of $32.7M in cash, $85.9M of receivables, $19.2M worth of inventory and $43.4M of other short term assets overtop of $79.8M of short term liabilities.

While their cash and A/R easily cover their financial commitments over the next twelve months, the fact that we are still seeing (I pointed this out in Q2) receivables up over last year on 31% less revenue stands out like a sore thumb. The near $86M is close to half of their YTD revenues and the company does not provide any aging reports to ease one’s concerns. It’s possible some of these amounts are within hold backs, but again they only provide this disclosure annually rather than quarterly.

ADF has $39.5M of debt, down almost $3M from the start of the year.

Cash Flow:

The company had a decent YoY performance within their operational cash flows $6M of OCF generated compared to $6.8M burned in Q3 last year. YTD is a much different story however with $13.4M of OCF versus $53.3M, nearly $40M less. $10M of that is form a higher income tax burden, but most of the variance stems from the loss on the top line. An improvement within their A/R collections could provide a swing to the positive which I would expect at some point.

ADF has invested over $25M through investing activities so far YTD, the majority of which ($16.4M) on the LAR acquisition.

Through their first nine months they have bought back $7.9M worth of stock, paid down $3.1M worth of debt and $1.15M in dividends.

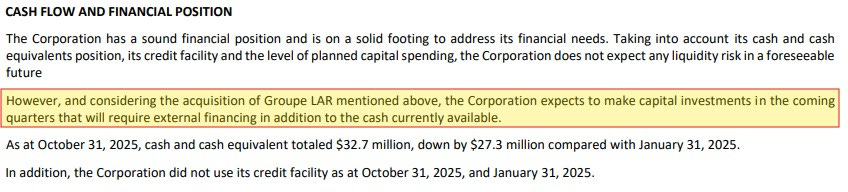

Overall their cash position has depleted by 45% since the start of the year. The company also had the following to say within their MD&A which indicates a likelihood of increased future debt.

Share Capital:

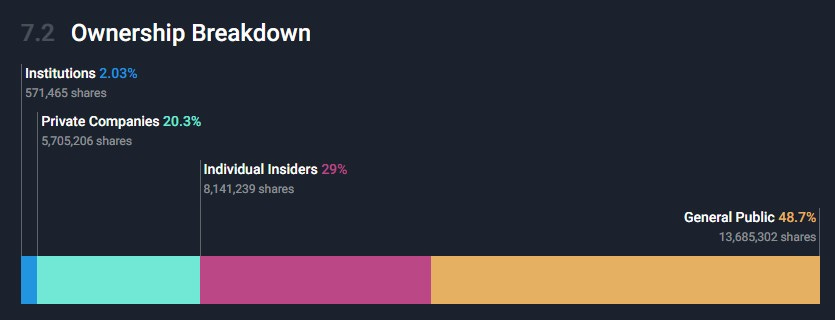

28.6M shares outstanding made up of 16M subordinate and 12.1M multiple voting shares

1.05M subordinate shares repurchased YTD

450k shares issued in Sept as part of the LAR acquisition

51% ownership between insiders, institutions and private companies

Income Statement:

Revenues continued to be soft in comparison to last year with $71.4M in Q3 compared to $80M, or off by 10.7%. Gross margin continues to lag last year but the variance was improved compared to their YTD trend. Q3 came in at 27.6%, 280 basis points less than last year with the majority of that impact due to tariffs.

Expenses also more than doubled compared to last year, up 119% to $5.5M. There were two main causes to this - $1.7M in SBC costs related to fluctuations in RSU/PSU valuations and $1.4M in costs related to the acquisition.

Net income in Q3 came in at $10.3M vs $16.4M or a decrease of 37%. That results in my first use of the new reverse Wolf Trifecta image.

On a YTD basis the theme is similar with the exception of savings on the operating expense side:

Revenues of $180M, down 31% from $262.2

Gross margins off by nearly 800 basis points to 23.8%

Expenses down 12.8%

Net income of $20M vs $47.7

EPS at $0.70 per share vs $1.53

Overall:

Once again, some rough P&L numbers as the company continues to deal with the negative tariff impact on steel.

Even with all of those challenges, the company still put 11% profitability on the bottom line, and as was suggested early this year, the back half is looking to shape up much better than the first one. Per the company’s earning call, Q4 should shape up similar to Q3.

On the more encouraging side is the 50% increase in DRX’s backlog compared to this time last year. Even more encouraging is that backlog is 57% Canadian content, compared to 90% USA at the start of the year. That of course should have some positive margin impacts and reduce the overall impact of tariff risk to their fiscal 2027 results.

Of course once the tariff situation has been resolved that should help to buoy the company even further. Based on most recent news, a near term solution is not one investors should be banking on however. The company would also likely benefit from increasing Canadian infrastructure projects, and will gain operational synergies from the LAR acquisition.

In terms of pricing I still believe their is value here given the better outlook for next year, particularly given the company’s 4.7 EV/EBITDA and sub 8 P/E ratios. I feel overall the company has weathered the shit storm quite well, in Steel Blue fashion.

Maintaining my 3.25 star rating.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

does any of the backlog have any clauses which state if we cancel we ow x? I am interested in backlogs and the value of them if they cancel. Nice job on the review and 11% is pretty good.

The A/R would be a big concern for me. Would seem like they are billing progress payments and then likely allowing the counter parties to delay until the whole project is completed. Their balance sheet would allow this (albeit with a drawdown). Once this reverses (which I suspect the market could care less about), it could be time to re-enter this. management seems sound and is navigating a difficult environment the best they can. however, this environment means you are pedalling uphill still IMO.