Yes, I know. I’m late to the party. Shut up.

What a party it has been, with a 91% increase in share price so far in 2024. But it also peaked close to $21 after their Q1 release and has taken quite the beating, down 36% since that June 12th date. Getting Jekyll and Hyde vibes so let’s see if we can figure this one out.

Balance Sheet:

Quite strong current ratio of 2.1 with major components of $76M in cash, $50.3M in receivables, $14M worth of inventory against $80.9M of liabilities due within the next year. Strong liquidity here with their cash position alone almost covering their bills due over the next year. No aging report which is disappointing but A/R well down from the beginning of the year and the overall number doesn’t frighten me. ADF has just shy of $44M of debt.

Cash Flow:

Incredible cash flow producing company with $60M of operational cash flow generated half way through the year. over 19% better than a year ago and over $10M of OCF a month. Each of their first two quarters may look a little misleading to investors due to the extreme fluctuations in working capital adjustments. The company would have shown operational burn of $22M in the first quarter, and $82M of positive flow in this quarter. Neither are really representative of their performance, but the blended together and the YTD numbers are a pretty good picture of their capabilities moving forward. It’s also notable that they are $10M better in OCF after paying almost an additional $10M in taxes YTD.

They utilized this YTD windfall to purchase $5.6M in assets, paid down $1.5M of debt and $48.3M of buybacks. Forty Eight MILLION of buybacks. The choice of utilizing the cash for buybacks over debt is a clear choice and an indicator of where leadership sees more value. Given the interest on the debt are at quite decent rates given the times, it looks like the prudent move as well.

So even with utilizing nearly $50M in buybacks and other asset purchases so far this year, they still increased their cash position by $3.6M from the beginning of the year.

Share Capital:

Nice small float of just 29.9M shares outstanding, a reduction of 8.4% from the start of the year which was just six months earlier

That 29.9M of shares is made up of 17.8M subordinate shares and 12.1M multiple voting shares that carry 10x the weight when it comes to voting. I’m not a fan of this type of share structure

Notable that 500k of subordinate shares were repurchased and 2.26M of multiple voting shares were purchased from insiders (at $17.31/share)

Due to the multiple voting shares, insider ownership is significantly understated. Insiders effectively control nearly 90% when it comes to voting rights

About 900k in RSU/DSU/PSU’s outstanding as of the end of last year. No updated numbers in the quarterly statements and if I have to be honest I think the formatting of their financials sucks ass

For some reason they pay a 0.16% yielding dividend. Why?

Income Statement:

It’s never great to start with a 6.6% revenue decline in the quarter, but that’s what we have with total revenue coming in at $74.9M compared to $80.2M. YTD looks much better however with the top line up 13.6% to $182.3M vs $160.5M.

What sets their financials apart from a year ago is their gross margin story seeing a 1470 basis point improvement in the quarter to 36.9% and 1300 basis point improvement YTD to 32.3%. Revenue is up by less than $22M from last year, while their gross margin is up by over $27.5M. Wait, what?

SG&A expenses on a YTD basis grew at a higher rate than revenues at 22% up from last year. Sadly they do not break this down within the notes but we can see that SBC costs rose by $3M over last year which likely indicates that cash burning expenses were actually down from last year. It would be nice if they broke that down to award them full credit.

What we can give them credit for is increasing their net income by over 96% on just 14% more revenue, and once again that is AFTER paying $9.3M more in income taxes.

Massive YTD performance.

Overall:

So, why did the stock take such a shit kicking since June 12th? It’s pretty simple, the company utilized their retained earnings to reward themselves with a $48M bonus via share buybacks on a skyrocketing share price. It’s ok though, they just gave you a 2 cent dividend.

Market isn’t going to like the quarterly revenue decline of nearly 7% and I imagine they will overreact to this number. Retail will also likely over react to the $35M delay to one customers project. Bottom line is construction delays always happen and they didn’t get the business in the quarter.

Biggest question is how sustainable are these margins? The MD&A kind of gives the impression that these margin rates are probably as good as it gets and margins should “stabilize”. That’s a pretty broad statement and I’d feel more comfortable with better guidance. My guess is we will see margins retreat somewhat in future quarters.

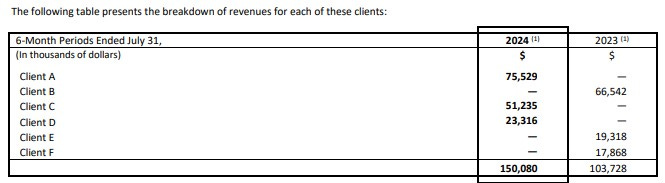

82% of their YTD business came from just three customers, and 65% of their business came from three different customers a year ago. Investors need to therefore be prepared for the risks of lumpy revenue performance which could happen at any time and potentially be severe swings. The backlog number is solid, but I’m not a huge backlog guy so I don’t factor that much into my investing thought process.

So yes, kickass profitability in the quarter despite the revenue erosion and YTD numbers are excellent as well. But I don’t see ADF Group as one of those slow steady movers that will gradually increase in price. Investors are going to need some TUMS handy for this one, so you better have the stomach for it. No better proof of that than the first half hour of trading since the market opened.

Given some of the concerns in the last couple of paragraphs, investors shouldn’t expect similar multiples as other sectors or companies either. With that said, I have the EV/EBITDA on a TTM basis at 5.2.

For that reason I’ve slapped the ask twice this morning. Then I listened to the call and had a little regret, LOL. Pass the Tums. 3.75 stars.

Have an request to review a stock you are interested in? Visit the TSA discord to make your request in our dedicated channel or email us at thewolf@wolfofoakville.com

Chat with me and 2900+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings and I do so without compensation. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Solid quarter. Lumpy revenue with a delay on one project. Agreed with expecting a decline today mainly due to revenue decline. Took some tums and added to one of my smaller positions.